Find the one for you!

Business Banking Solutions

Built with your small business in mind.

When Choosing a banking platform for your small business, consider the following options:

* We do use affiliate partner links on this page but only recommend platforms we use in our own business!

Relay*

-

Free business banking with extensive features.

-

Ideal for small to medium-sized businesses of any entity type.

- Up to 20 separate bank accounts for efficient cash segregation and bill payments.

- Supports Profit First methodology with auto-transfer rules to put Profit First allocations on autopilot.

- Receipt Management Feature

- Offers cash withdrawals/ deposits at Allpoint ATMs.

- Allows team member or advisor access.

- Suitable for business owners who have more than one entity.

Novo**

- Free business banking with a sleek interface and lots of third-party integrations.

- Best for solopreneurs or small businesses with a simplified account setup.

- Great for those that want built-in invoicing functionality.

- Separate reserves within the main account and automated savings into up to 10 designated buckets.

- ATM withdrawals up to $1,000.

- Suitable for a business owner with one entity.

*Relay Disclosure: Relay is a financial technology company and is not an FDIC-insured bank. Banking services provided by Thread Bank, Member FDIC. FDIC deposit insurance covers the failure of an insured bank. Certain conditions must be satisfied for pass-through deposit insurance coverage to apply.

**Novo Disclosure: Novo is a financial technology company, not a bank. Banking services are provided by Middlesex Federal Savings, F.A.; Member FDIC.

Other Options for Banks:

Want to compare the banking platforms above with other business banking options? Here is an assessment of the pros and cons of local credit unions and "Big Name" banks. Remember to consider factors such as fees, transaction limits, integration capabilities, and overall suitability for your business's specific needs when choosing a banking platform.

Local Credit Unions

Pros:

✓ Personalized service and community-focused approach

✓ Competitive interest rates on loans

✓ Lower fees compared to big banks (though usually not free)

Cons:

- Limited branch and ATM network

- Harder to open and manage multiple accounts

- Potentially fewer advanced digital banking features

- May lack specialized business banking services

- Limited resources and financial products

"Big Name" Banks

Pros:

✓ Extensive branch and ATM network

✓ Wide range of business banking products and services

✓ Advanced digital banking platforms

✓ Potential for more financial stability and resources

Cons:

- Typically the highest fees

- Harder to open and manage multiple accounts

- Often have minimums that must be met

- Less personalized customer service

- Stricter lending criteria

Personal Finance Solutions

* We do use affiliate partner links on this page but only recommend platforms we use with our own family!

If you’ve ever wished for one place to track your spending, budget with intention, and actually feel in control of your finances, Monarch might be your new favorite tool.

With Monarch, you can:

-

Track all your accounts in one dashboard

-

Choose your budgeting style (flexible or structured!)

-

Collaborate with a partner or financial advisor

-

Set financial goals and stay on track

-

See your net worth and investments in real-time

-

Enjoy an ad-free, distraction-free experience

It’s available on web, iOS, and Android — so you can manage your money wherever life takes you.

Crew is redefining what a checking account can do. It's smart, flexible, and packed with features that make managing your money (and your family’s money) easier than ever — no fees, no minimums, no stress.

Why Jamie loves Crew:

- High-yield checking that beats most savings accounts

- Built-in budgeting with pockets to organize your money

- Automated paycheck splitting — set it once and forget it

- Family banking made simple — open child accounts for free (no age limits!)

- Automation rules to control how and when your money moves

Whether you’re managing your business finances, household budget, or teaching your kids about money — Crew makes it all smoother.

Greenlight makes it easy to give your kids financial independence while keeping you in the loop. Whether it’s for allowance, spending money, or managing kid-related expenses — it’s simple, secure, and totally parent-approved.

With Greenlight, you can:

- Send money instantly to your kids — anytime, anywhere

- Set spending controls and real-time notifications

- Encourage goal-setting and saving habits

- Use it for nanny or caregiver purchases too!

- Help kids learn how to manage their money in a safe, guided way

Jamie uses it with her own kids — and loves how easy it makes financial education at home.

*Crew is a financial technology company, not a bank. Banking services provided by Bangor Savings Bank, Member FDIC. Annual Percentage Yield (APY) is variable and may change after account opening. There is no minimum balance or deposit required to obtain the advertised APY. Fees may reduce earnings.

Get Our Ultimate Getting Ready for Taxes Bundle ($149 Value) for free when you use our link to sign up with Novo or Relay AND you fund your account!

To get the Bundle:

1) Complete the enrollment process with one of our recommended banking solutions through our partner link above

2) Fund your new account to get started.

3) Submit this form and relax while we verify your sign-up (usually within 48 business hours)

4) Our support team will then contact you and if eligible will grant you access to the Bundle.

Need Something Else for Your Business?

We've done the research. Take a look at who we recommend...

Best

Payroll Solutions

Recommended for small businesses who need to run payroll.

We've partnered

with OnPay, Gusto & ADP to bring you special negotiated deals for your biz!

Use our simple Payroll Provider Decision Tree to help you find the best options for your business's payroll! Then get the best bang for your buck when you use our partner links to get started. Plus after you sign up you can grab your Hiring Cheat Sheet Guide totally FREE from us!

Find the Best Payroll Solution for Yor BizBest Business Credit Cards

Recommended for individuals and business owners looking for my top recommended credit cards.

We've partnered

with Travel Freely to bring you the BEST deals!

If you know me, you know I’m SUPER careful about recommending the use of credit cards. Carrying credit card debt is an expensive form of financing, so I don’t recommend using one if you aren’t sure you’ll be able to pay your balance in full each month.

However, for those that use them responsibly, credit cards can be a good way to build credit and earn points for purchases you are already making.

Best Accounting

Solutions

Recommended for small businesses, solopreneurs, or freelancers who have outgrown a spreadsheet.

We've partnered

with

Freshbooks, QuickBooks, and Xero Online to get you one of the BEST deals available!

While QuickBooks Online is the best-in-class accounting solution, we know it is not right for every business. Now, you can use our simple flow chart to help you pick the best accounting solution for your business.

Find the Best Accounting Solution for Your BizBest Lending Solution

Recommended for small businesses owners looking for cash flow assistance or capital to help them grow.

We've partnered with Lendio to help you find affordable access to funding!

For business owners who want to use debt financing responsibly and reduce interest charges. Lendio can shop around for you and give you personalized funding options, like a line of credit or SBA loan, that fit your needs.

Watch My Reviews for Business Banking Solutions...

Read More

Why I switched to Relay Business Banking? 3 Hidden Benefits

As your business grows your banking needs do as well. That is why we have partnered with banking platforms to help you find the provider with the solution that is best for where you are in your business.

Read Article

In case we haven't met,

I'm Jamie!

>>>>

Financial Literacy Coach, Hamilton superfan, an enjoyer of a glass of Cabernet with a good mystery book, and — if you like —your guide as you get allll those numbers together.

Even though I’ve got a CPA license and 15 years of experience in finance and accounting, my real passion is explaining complex topics to small business owners and solopreneurs in a non-technical way to make them easy to understand and put into practice.

I’m not one of those accountants that will use a whole bunch of buzz words and jargon…we won’t be talking about things like “EBITDA” or “synergies” here (UGH). Instead, it’s all explained in words that make actual sense in the real world of entrepreneurship.

In other words, I’m not your father’s CPA.

And my #1 mission is to see more entrepreneurs not just surviving, but THRIVING in both their professional and personal lives.

Learn More

Loving the goodness?

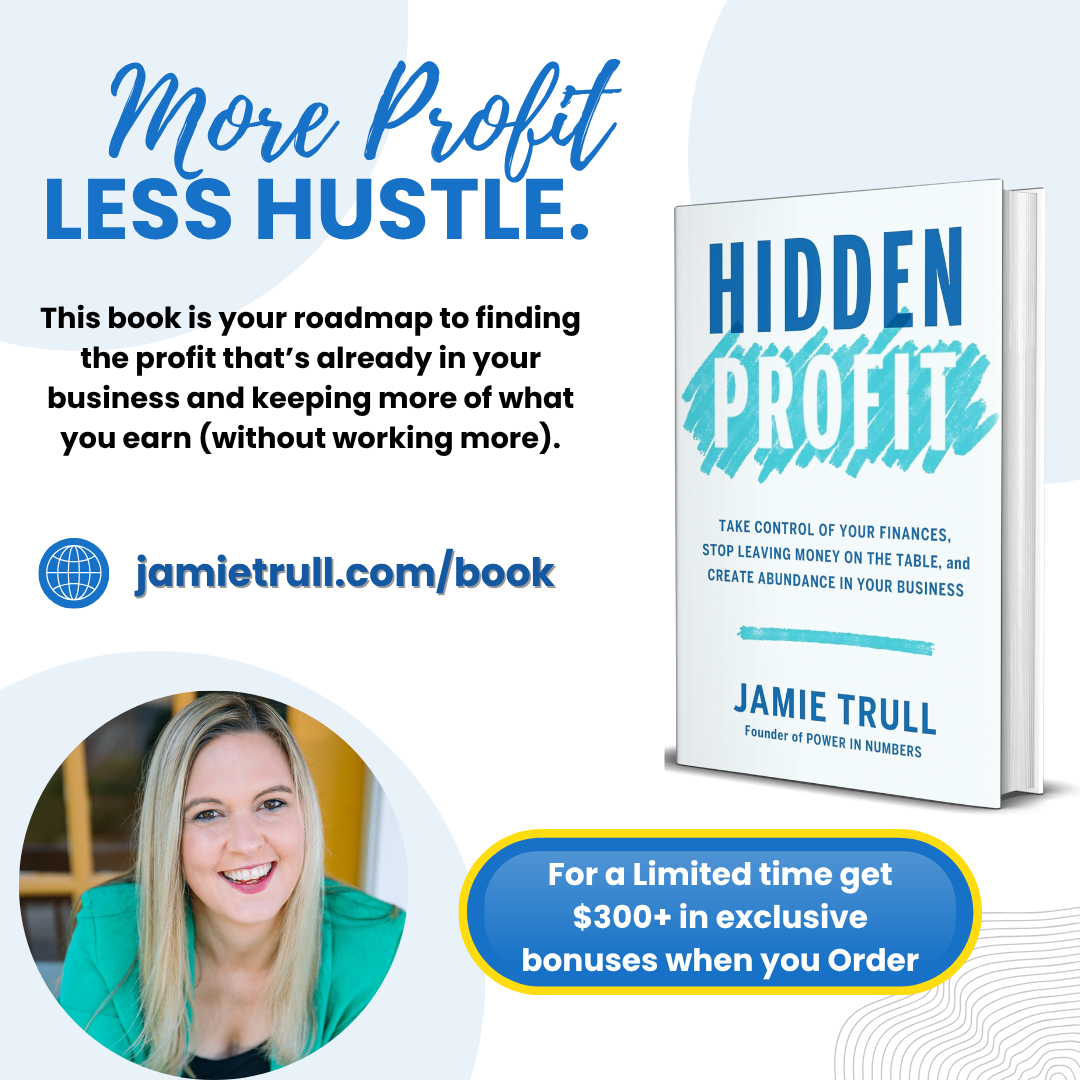

Keep going with Jamie's New Book.

You’ve just uncovered some fascinating insights about your money personality. Ready to turn those insights into consistent profit and a rock-solid business strategy? Jamie’s new book will show you exactly how—and it’s available now!

It’s called Hidden Profit: Take Control of Your Finances, Stop Leaving Money on the Table, and Create Abundance in Your Business, and it’s a must-have for entrepreneurs who are ready to thrive.

Why This Book?

-

Tailored Strategies: Jamie teaches you how to build a plan based on your money personality—no cookie-cutter advice here.

-

Real Clarity: Learn how to actually understand your numbers so you can make smart, confident decisions that grow your bottom line.

-

Hidden Profit Levers™: Discover exactly where money is hiding in your business (and how to get your hands on it without burning out).

-

More Freedom: Pay yourself consistently, plan for the future, and finally create the business that supports the life you want.

This book is your roadmap to building a profitable, sustainable business—without all the confusion. Grab your copy today and start uncovering the hidden profit in your business!

Get Your Copy of Hidden Profit Now!Looking for other solutions for your small business?

Check out all our recommendations and special negotiated deals, including our AH-MAZING offer for QuickBooks Online, Payroll Solutions and MORE on our full Favorite Things List!

Take me to the Favorite Things List!A Note from Jamie:

We only recommend partners we believe in and trust. The select companies we affiliate with are ones we personally use in our business, and we stand by the quality and value they offer to our community.

Some of the partner links on this page are affiliate links, meaning we may earn a commission if you make a purchase through these links, at no extra cost to you.